Dividend

Buyback of Shares

Reduction of Capital

Royalty & fees for technical services

Consultancy services

Pre Incorporation Expenses

Other remittances

Dividend

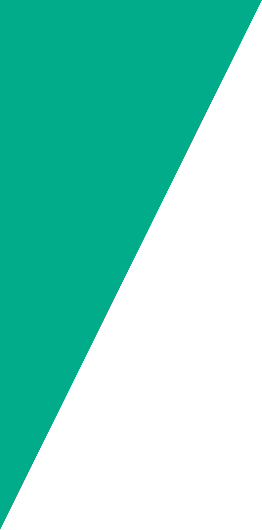

Profit and dividend earned from an Indian company are repatriable after payment of dividend distribution tax (DDT). DDT @ 16.995% (inclusive of cess) is payable by the company (that declares dividend) on the amount of dividend distributed. However, dividend is free of Indian income tax in the hands of the recipient shareholders, Indian or foreign. Profit of LLP is flow-through and repatriable without payment of any taxes and without any regulatory approval.

Buyback of Shares

Profit earned from an Indian company can be repatriated alongwith capital by way of buyback of shares after paying buy back tax @ 20% on profits distributed by companies to shareholders through buyback of shares. Such a tax is not applicable if the company concerned is a widely held company having substantial public interest (ie. a listed company or a subsidiary thereof etc.)

Reduction of Capital

Surplus capital of Indian company could be reduced in lieu of cash payment to the shareholders. Such a payment, however, attracts dividend distribution tax to the extent of accumulated profits (whether capitalized or not). Repayment over and above accumulated profits is subject to capital gains tax, subject of course to Double Taxation Avoidance Agreement, where applicable.

Royalty & fees for technical services

Rate of tax on royalty and fees for technical services for non-resident tax payers under the Income-tax Act is 25% in respect of agreements entered into after March 31, 1976. Non-residents can continue to avail of lower tax rates under the Double Taxation Avoidance Agreement, where applicable. Tax treaties such as those with Netherlands and Singapore prescribe for a lower tax withholding of 10%.

Consultancy services

Remittance of up to US$ 1m per project for any consultancy service procured from outside India can be made without prior RBI approval. Limit for entities in the power, telecommunications, railways, roads including bridges, sea ports and airports, industrial parks, urban infrastructure (water supply, sanitation and sewage projects) sector, is extended to US$ 10m per project.

Pre-incorporation expenses

No RBI approval is required for remittance up to 5% of the investment in Country, on the reimbursement of pre-incorporation expenses incurred in India amounting or US$ 0.1m, whichever is higher, on the basis of certification from statutory auditors and on the basis of some basic documentation.

Other remittances

No prior approval is required to remit profits earned by Indian branches of companies (other than banks) incorporated outside India to their head offices outside the country. In addition, sundry remittances are allowed for certain items, including gifts, repair charges for imported machinery, maintenance and legal expenses, subject to prescribed limits.