LLP is a Limited Liability Partnership and regulated by the Limited Liability Partnership Act, 2008 and Limited Liability Partnership Rules,2009.

FDI in LLPs is permitted up to 100% in sectors/activities thatare currently eligible for 100% FDI under automatic route and which do not have any FDI-linked performance conditions (such as ‘Non Banking Finance Companies’ or ‘Development of Townships, Housing, Built-up infrastructure and Construction-development projects’ etc.)

Key Features

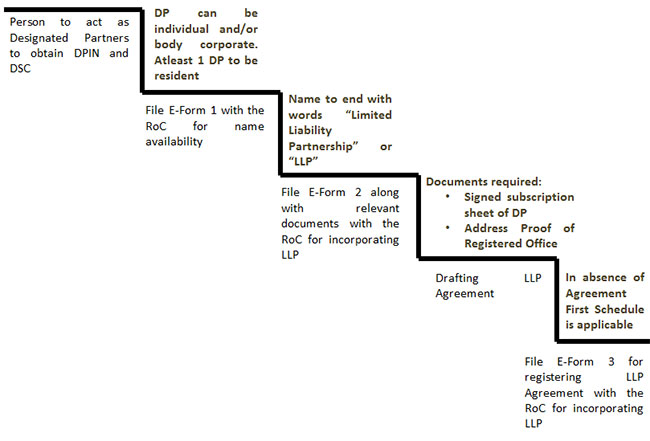

- LLP must have minimum two designated partners. One of the designated partnersmust be Indian resident.

- Designated partners are responsible for overall management of the LLP.

- Only the designated partners are required to have DIN (Director Identification Number). All partners are required to have PAN card or Passport.

- Charter document of LLP is LLP Agreement which needs to be drafted keeping in view all activities to be carried out by LLP, the rules regulations of the LLP, rights and duties of partners, the profit and loss sharing ratio, accounting treatments and the like.

Process of incorporation of LLP