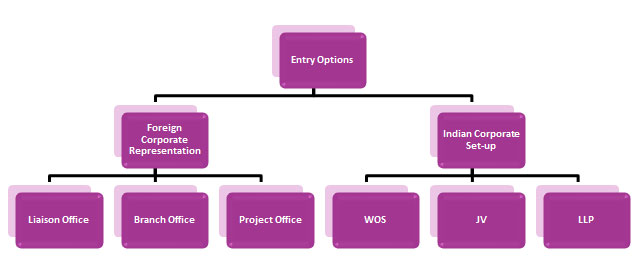

Choosing an appropriate form of business entity, which would facilitate achieving the desired results, is the first step towards setting up of any business.A foreign company or individual can set up business operations in India in the form of:

Particulars |

Project Office |

Branch Office |

Liaison Office |

Subsidiary Company |

LLP |

Legal Status |

No separate legal status as it is extension of parent company |

No separate legal status as it is extension of parent company |

Represents the parent company |

Separate legal Status |

Separate legal status |

Process of |

On fulfillment of stated conditions, no prior approval required |

Prior approval of RBI required except for undertaking manufacturing and providing service activities in SEZs (Special Economic Zones) |

Prior approval of RBI required |

No prior approval of RBI required under automatic route but only post-facto filings to be undertaken with RBI Prior approval of RBI required under approval route and thereafter post-facto filings required to be undertaken with RBI |

Prior GoI/FIPB approval required |

Scope of |

Restricted scope |

Restricted scope |

Liaison activity |

Significant flexibility |

Activities for which 100% FDI is allowed without any approval |

Income tax rate |

42.02% on a net income basis (40% plus 2% surcharge plus 3% cess thereon) If Minimum Alternative Tax (MAT) is applicable, it is levied at 19.44% of book profits (18.5% plus 2% surcharge and 3% cess) |

Generally, no tax liability, since it cannot carry out any commercial or income earning activities |

Generally, no tax liability, since it cannot carry out any commercial or income earning activities |

32.45% on a net income basis (30% plus 5% surcharge plus 3% cess there on) If MAT is applicable, it is levied at 20.01% of its book profits (18.5% plus 5% surcharge plus 3% cess) |

30.90% on a net income basis (30% plus 3% cess there on) If AMT is applicable, it is levied at 19.05% of its book profits (18.5% plus 3% cess) |

Ease of exit |

Easy |

Easy |

Easy |

Complexity will depend on type of strategy adopted |

Complexity will depend on type of strategy adopted |

Compliance requirements under Companies Act |

Registration and periodic filing of accounts/ other documents |

Registration and periodic filing of accounts/ other documents |

Registration and periodic filing of accounts/ other documents |

Registration with ROC with various statutory compliance and filing requirements |

Registration with ROC, financial statement filing and submitting annual statement on solvency |

Compliance requirements under foreign exchange management regulations |

Required to file an annual activity certificate (from auditors in India) with RBI |

Required to file an annual activity certificate (from auditors in India) with RBI Combined annual activity certificate can be filed in case of multiple Branch Office |

Required to file an annual activity certificate (from auditors in India) with RBI Combined annual activity certificate can be filed in case of multiple Branch Office |

Required to file periodic and annual filing relating to foreign liabilities and assets, receipt of capital and issue of shares to foreign investors |

No filing requirements prescribed as of now |